owner's draw in quickbooks self employed

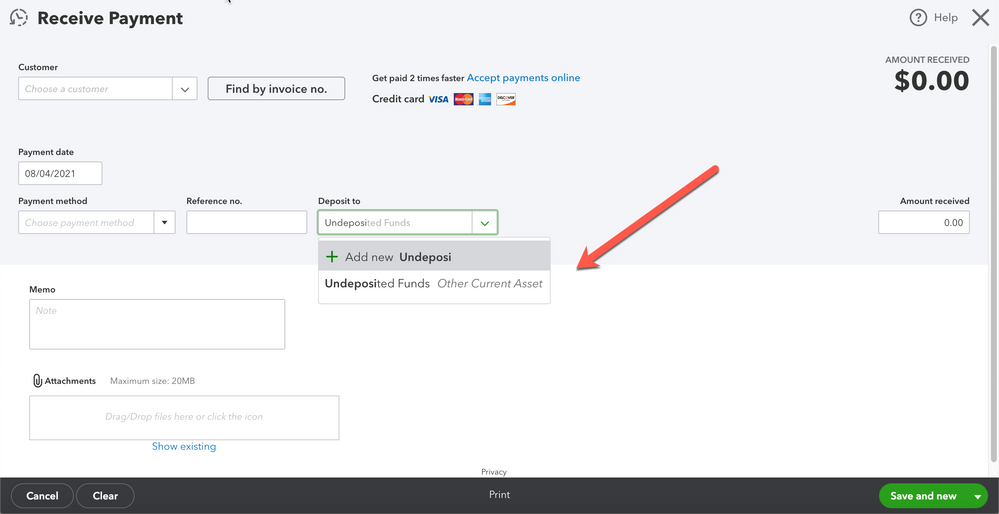

If QuickBooks displays the Payments to Deposit. Click the Banking tab in the main menu bar at the top of the screen.

How To Pay Invoices Using Owner S Draw

Select Make Deposits from the drop-down menu.

. 1 Best-Selling Tax Prep Software. As a business owner you are required to track each time you take money from your business profits as a draw or owner salary payment for the purpose of calculating the. If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the.

Global Payables Automation Software Built For QBO. 1 Best-Selling Tax Prep Software. Ad Master Invoicing Payroll Inventory Taxes More - Start Today.

Ad QuickBooks Online Official Site. Free Up Time For the Work You Love. Ad QBO Integrated AP Automation Solution.

Close Your Books Faster Today. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. Step 4 Click the Account field drop-down menu in the Expenses tab.

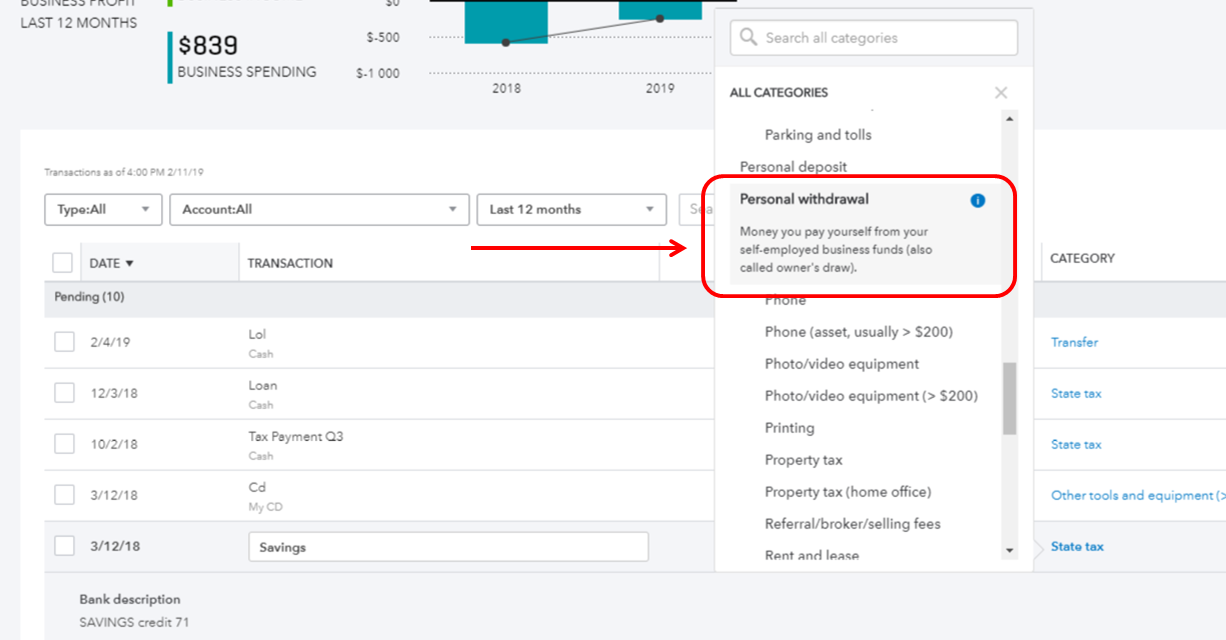

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Type the owners name if you want to record the withdrawal in the Owners Draw account. Select Petty Cash or Owners.

Instead you make a withdrawal from your owners. For accounting purposes the draw is taken as a negative from their business. Ad QuickBooks Online Official Site.

Follow these steps to set up and pay the. Easy Invoice Approval Workflows PO Matching. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary.

Ad Users Who Switch To FreshBooks Get Up To 16 Of Their Invoicing Time Back. Join Over 24 Million Businesses In 160 Countries. For background our company used Quickbooks Enterprise for.

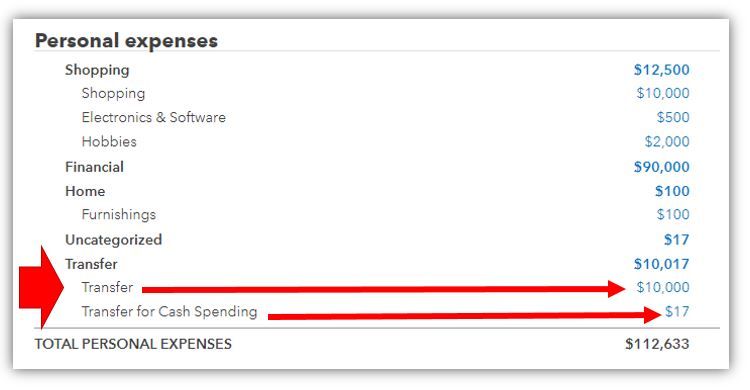

What Makes QuickBooks Self. Business owners generally take draws by writing a check to themselves from their business bank accounts. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

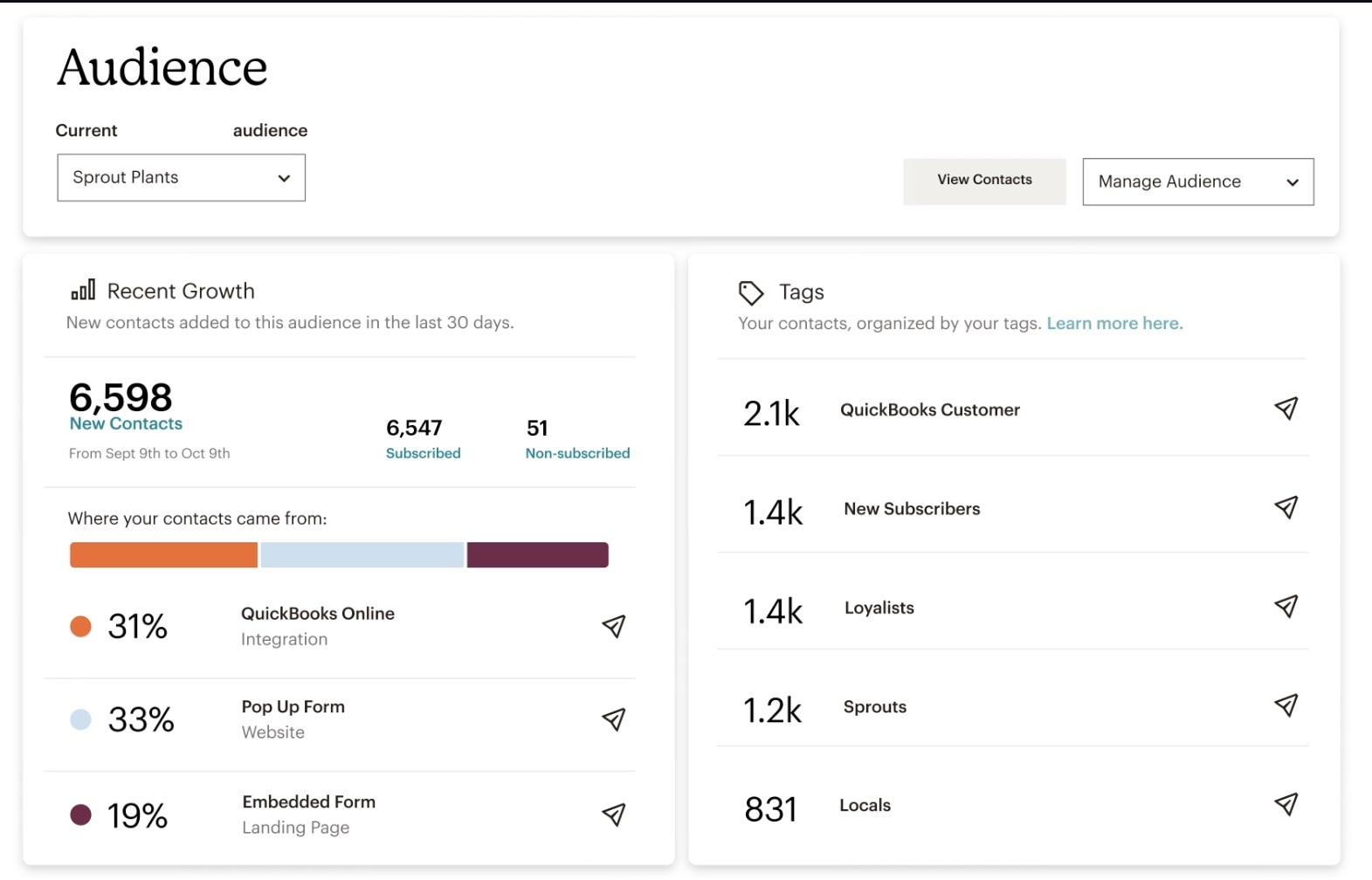

What is Up in Quickbooks Self-Employed Basics for Business Owners Online. While QuickBooks Self-Employed is the ideal software for freelancers QuickBooks Small Business is useful for sole proprietors LLPs partnerships non-profits and other such.

Using Undeposited Funds In Quickbooks Online

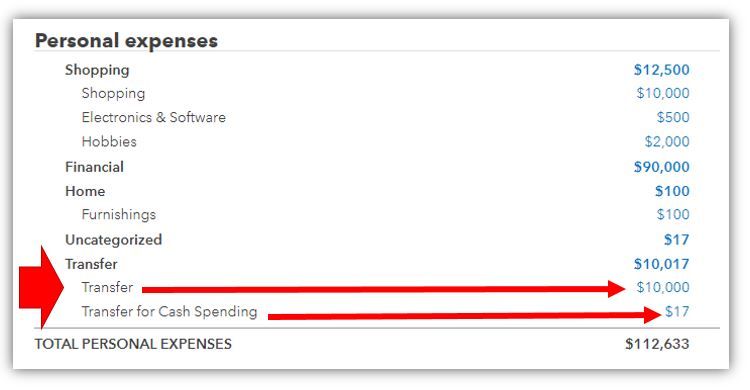

Categorizing Transactions In Quickbooks Other Bookkeeping Software Network Antics

Quickbooks Online Tutorial Recording An Owner S Draw Intuit Training Youtube

Solved Owner S Draw On Self Employed Qb

Setup A Draw From Quickbooks Self Employed

How Can I Run An Owners Draw Report To See The Total Drawn

Learn About Money Market Accounts Not Your Typical Accounts Personal Finance In 2022 Finances Money Personal Finance Finance

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

What S New In Quickbooks Online November 2021 Quickbooks

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

Solved Owner S Draw On Self Employed Qb

Infographic On Llc Business Finance Business Savvy Business Tips

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

How Do I Enter The Owner S Draw In Quickbooks Online Youtube